Taxes and Calculation Rules Edit

You will create a tax for rule for each tax that you are required to collect, then as you create each product the tax will appear as an option for you to select. You can also use this to create discounts for groups such as employees or wholesale customers.

Tax calculation rule Tab

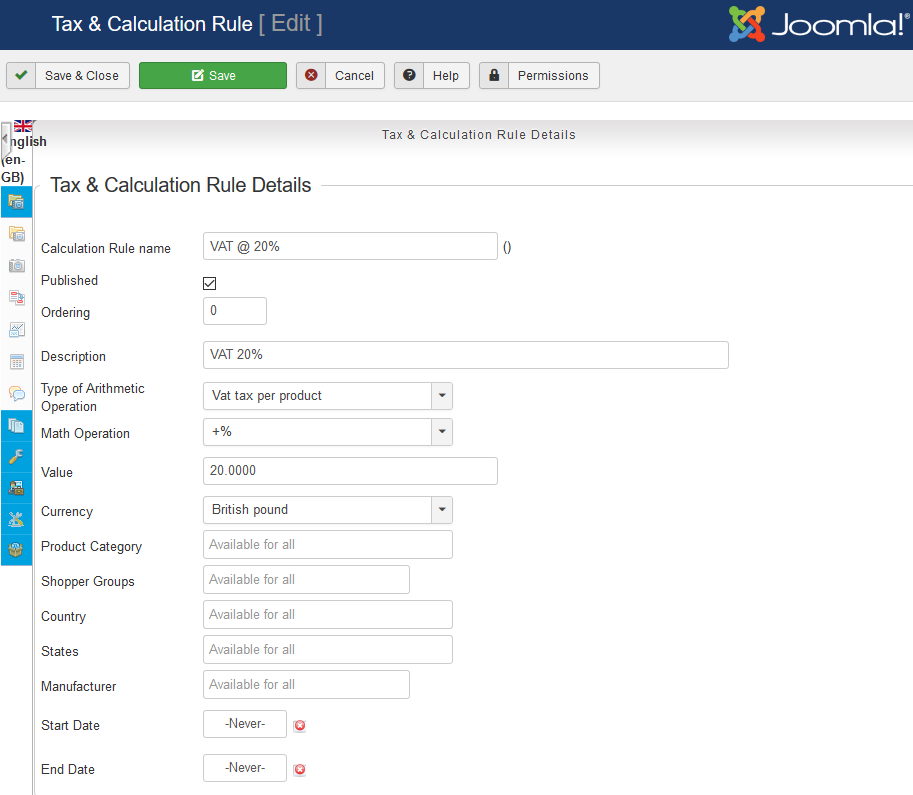

The screen you see when editing a tax calculation rule along with a description of the fields and their purpose is shown below.

Tax & Calculation Rule Details

Calculation Rule Name

The name to be used in your system for this Tax and calculation rule.

Published

Check to enable or disbale this rule

Description

A text description for use by administrators.

Ordering

The sequence priority for application of the rule - lowest to highest.

Type of Arithmetic Operation

The calculation type for the rule.

Math Operation

The math operation type - addition or reduction as a percentage or fixed value.

Value

The value for the math operation.

Currency

The currency used for the rule.

Product Categories

Categories to which this rule will be applied.

Countries

Shopper location countries to which this rule will be applied.

States

Shopper location country states to which this rule will be applied.

Manufacturer

Manufacturer to which this rule will be applied.

Shopper Groups

Shopper groups to which this rule will be applied.

Start date

The Tax and calculation rule is applied from this date.

End date

The Tax and calculation rule is not applied after this date.

Additional information

The Arithmetic operation Rules

We have two primary types of rules, per product and per bill/cart.

Rules per product are calculated for each product shoppers will see these in the product details view and per product listed in the cart.

Rules per bill/cart are using the subtotal of all products and shoppers will see thes in the cart and the cart module.

Each calculation rule is assigned an arithemetic operation type:

- Profit margin

- price modification before tax

- Tax

- Value Add Tax

- price modification after tax

The price modifications can be used as discounts or for any purpose you can conceive. Any arithmetic operation can be used with any mathematical operation.

Tax is meant for goods which are taxed by weight, unit, or similar.

VAT Tax is recalculated and lowered by given discounts.

Combined with the multi currency system of VirtueMart and the profit margin you can dynamically calculate your desired cost or final price.

Restricting rules

Rule configuration options create dependencies/restrictions based on other aspects of your store or shoppers. VirtueMart follows the simple rule that "no entry" means no restriction (Available of all), which means for the most part you can leave configurations empty at first.

Restrictions include

- shoppergroups

- categories

- manufacturers

- countries / states

- effective dates.

Notes to the rules per bill

Per bill rules only function for categories they do not work for manufacturers.

notes to the vat tax

If you use a "VAT tax per product" for your products, then the VAT tax is lowered if any discount is applied after.

Your shopper's cart is likely to have products with different VAT tax rates in their cart. If a discount or coupon is used, then the VAT tax is lowered in correct relation to the applicable VAT taxes.

You can also use unpublished categories to add a tax to your products and set then the correct category in the VAT tax rules per bill.

Countries and States need the address of the user or some plugin that identifies the users country from their browser detail.

Try Running some configuration tests

Before you start to create your final store It is always worth running a few scenarios for possible options on a test system to fully see the power and possibilities of various configurations , of course, you may need to configure new rules when your store is live to create new business opportunities - but even in this case there is no substitute for trying these out in a test environment,

Here some more abstract overview about this topic http://docs.virtuemart.net/manual/general-concepts/204-tax-an